Written by Maurice Cardinal

*It’s much easier to load your digital gold investment on a flash drive than it is to stuff bullion in your pocket.

It’s also why governments are fearful of crypto and want to regulate it. Governments feign to institute regulations to protect investors, but mostly they are protecting their national gold reserves and the value of their country’s respective fiat. Keep in mind though that not all crypto coins aspire to or should be considered traditional money, many, too many, are simply speculative assets and need to be excised.

Even though corporations more and more are developing stable coins tied to real world utilities, the initial use was and still is money. Theoretically, on the very conservative side, if crypto captured a modest twenty percent of the off-shore market it would amount to several trillions of dollars, and that alone more than justifies its existence, at least for now and into the near future.

Combine this with Smart Contracts and the case for crypto gets even stronger.

In 2018, Ether was considered by some as a reserve currency for distributed investment banks, while Bitcoin was considered as a currency for distributed central banks. The run up in 2017-8 was supported in large part by ICOs outside of the jurisdictions of the SEC and similar agencies. Billions were invested amidst wild fluctuations, and the results were sometimes catastrophic.

2019 will be different as governmental agencies begin to institute and monitor regulations. At the end of the day Ether proved that with the right management and design, it could be “censor resistant.” It gave large corporations even more confidence to develop deeper and faster. The reality though is that we are many years away from mainstream adoption for any crypto coins, including Bitcoin – it takes time to change systems.

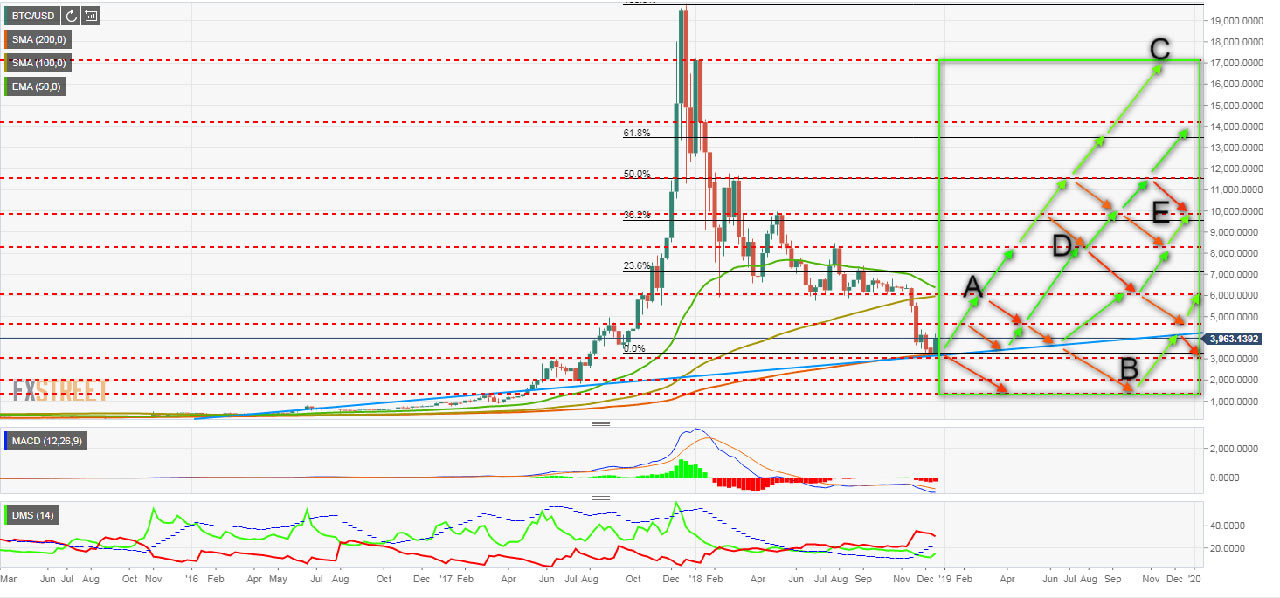

At this stage it’s important to consider the long tail, because nothing at this level happens overnight. Crypto traders are becoming increasingly smarter and cautious as evidenced by conversations in chat rooms. The parade of crypto gluttony has passed, and trading is now taking on a more studied approach. There is a lot of talk in forums about bears. It tends to slow everyone down to a point where they are more proactive than reactive – smart as opposed to emotional. The early 2019 market is well below its two-hundred-day average and looks oversold, which also makes traders cautious.

The good news is that many successful ICOs last year put an enormous amount of money in their corporate treasuries. The bad news is that as crypto values decreased, it meant shrinking capital for those same companies that were mandated through their ICO to develop blockchain and crypto ecosystems. When the potential for the market to collapse is high the natural tendency is to liquidate to head off further losses, and of course to pay developers and suppliers. Inflationary recession also has an impact, especially when an investor is torn between digital gold or traditional gold. Transparency is hyper-critical at this stage so investors can see what was raised and how it is being spent.

The shakeout will come when traders, who are tightly focused on profit, see more lucrative opportunities outside of crypto. History tells us that only diehard early adopters will stay the course. Governments are endeavoring to write and institute crypto regulations, but bureaucratic wheels turn slowly. If regulatory agencies don’t produce workable solutions, crypto could easily move underground, right where some people want it.

Crypto doesn’t fit neatly into the regulatory arena. During this transition there is a lot of confusion caused by agencies like the SEC, CFTC, and IRS as they race to see who will write regulations the quickest. Each agency in each country is doing the same, and most are not comparing notes.

Changes are happening relatively fast, even in countries like China where the drop in crypto values has caused their biggest crypto and blockchain companies, mining in particular, to move offshore, which ironically could make them even more powerful if they go underground and out of reach.

::::::::::::::::::::::::::::::::

Author Maurice Cardinal is a Blockchain Development Advisor and a Crypto Content Specialist at CoinSeason Capital Inc. Maurice has helped develop successful blockchain strategies and ICO campaigns for the news, gaming, healthcare, and cloud computing industries, and has researched, written, and advised about blockchain and cryptocurrency strategies for several years. Maurice is also the author of Leverage Olympic Momentum an early adopter business bible about disruptive marketing and growth hacking. He is also the Editor of CryptoFiatBlog.com

Author Maurice Cardinal is a Blockchain Development Advisor and a Crypto Content Specialist at CoinSeason Capital Inc. Maurice has helped develop successful blockchain strategies and ICO campaigns for the news, gaming, healthcare, and cloud computing industries, and has researched, written, and advised about blockchain and cryptocurrency strategies for several years. Maurice is also the author of Leverage Olympic Momentum an early adopter business bible about disruptive marketing and growth hacking. He is also the Editor of CryptoFiatBlog.com