*We are currently witnessing a holistic global restructuring of financial and investment ecosystems that includes utility tokens, commodities, fiat currencies, and securities layered on and within traditional as well as blockchain and crypto technology.

When you consider Bitcoin’s history and overall fundamentals, it can be argued that it could be the most robust crypto coin because it’s been around for almost a decade and has experienced a series of cycles. At this stage of crypto and blockchain development it’s critical to deep dive and look at the long tail in order to forecast which coins might survive and flourish, and which ones will fall to zero and disappear.

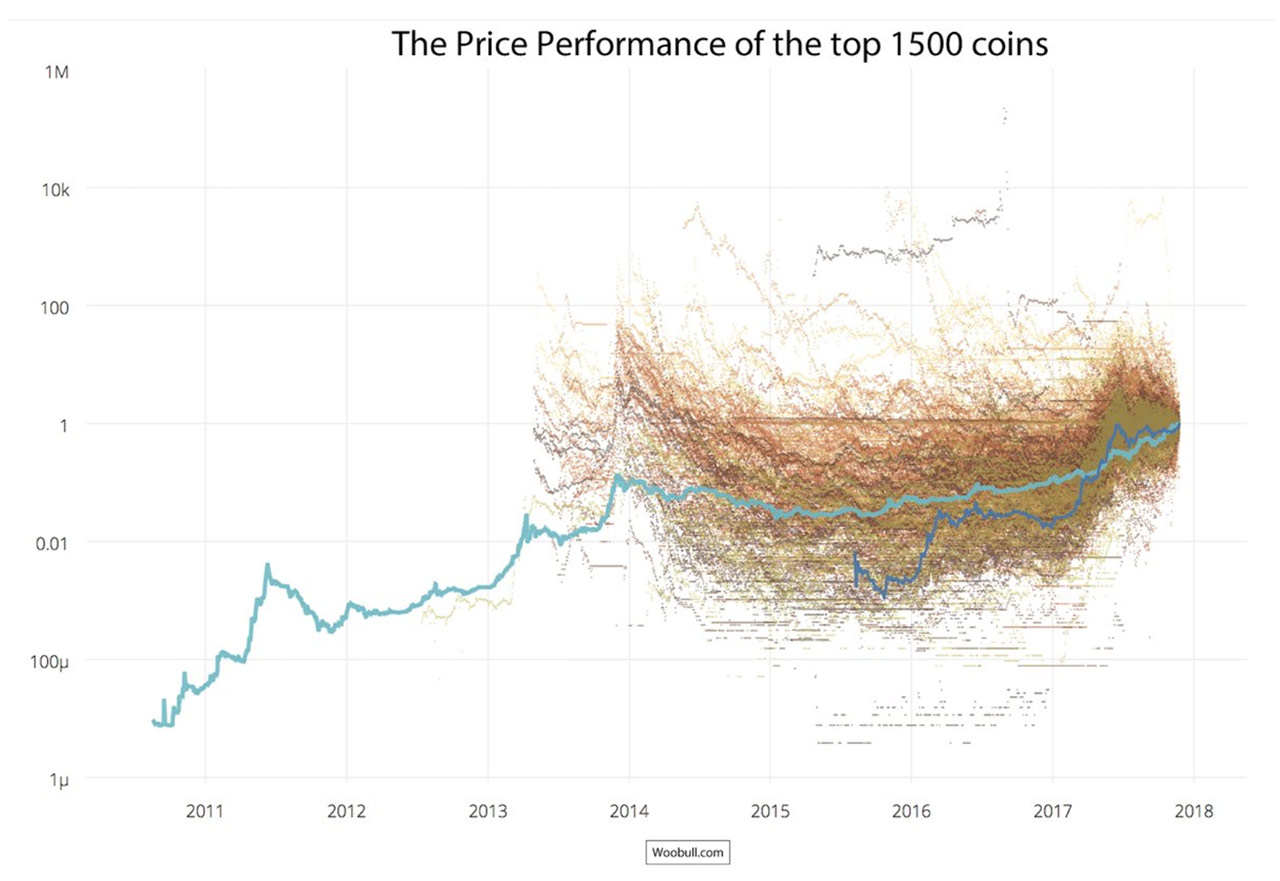

There are a number of coins in contention to push Bitcoin aside, but they are hard to identify because the market is over saturated with white noise from a phalanx of about two thousand other coins.

In order to maintain a “healthy” ecosystem we could easily lose at least half of the lesser coins. Some of the most aggressive performers respective of capitalization are Ripple and Tether – stable coins. In the long run, either of these coins, plus Bitcoin of course, have potential to deliver good value as digital gold, but the market is still too unpredictable to deliver that type of trust to experienced traders.

Stable coins are critical because they provide cross exchange liquidity and seamless trading between global entities, for example, Coinbase, Circle, and Paxos are centralized, fully reserved stable coins and considerably different than Bitcoin, especially regarding volatility. Maker and its Dai stable coin are also worth noting because even though Dai is tied to Ether, which is down like everything else, Maker is behind a series of experimental decentralised real-world applications, and has held its peg throughout the recent volatility. Granted, development for the most part is still relatively small, but censorship resistant applications like these companies produce provide traders with a sense of stability.

Don’t overlook the importance of “censorship resistance” or think that it is only a concern respective of China. Every country in the world is currently writing crypto regulations, and any of them could effectively shut down the blockchain in their jurisdictions, although it would be incredibly difficult, if not impossible. Censorship resistant basically means that every piece of data is stored on each node in the entire distributed system. If a country wanted to restrict data movement they would have to shut down an inordinate number of nodes that might/probably reside on servers in a variety of countries. It means you would need a collective effort, and that’s not likely to happen between countries that are competitive and that see value in their own provenance of blockchain.

The most noteworthy and critical crypto advancement in 2018 was related to the adoption of blockchain and crypto by institutional developers and investors. Even though Bitcoin in China is being used more and more in the retail sector, crypto-commerce migration has not happened in the rest of the world, and that type of scaling will take years to percolate into the consciousness of consumers and the mainstream retail masses. Bitcoin lost ninety percent of its value almost as quickly as it rose. The volatility spawned a sense of distrust that will have to be overcome before the retail sector gains traction. The public now needs a long and thoughtful stream of education to get them back onside and trusting.

The irony is that those who will benefit the most, average consumers, will have to wait for the financial ecosystem to evolve, just like they did when the internet first came on the scene in the late eighties.

Crypto is still hard to understand and adopt for most people, and too volatile for nervous newbies, which means that; Even though it is still the domain of the fastest gun slinging traders, anyone can get in the fight and draw down at the OK Corral! Just make sure you come armed with good information.

::::::::::::::::::::::::::::::::

written by Allesia Pomopliana

written by Allesia Pomopliana