DO TRADING BOTS WORK?

Can mathematics really predict a crypto trading trend?

Written by: Maurice Cardinal …

*Do you remember when your math teacher told you to pay attention because you’d need mathematics at different times throughout your life? Well, this is one of those times, and this time, the use is light years beyond what anyone could have ever imagined.

Let’s step back in history for a moment; The first decimal numeration system with place value concept was designed by the Chinese in 1200 BCE. It spawned a paradigm shift that thrust all core world societies forward.

Over the course of several centuries pre-BCE, the old-world Asian Trade Empire became the perfect storm to inspire Chinese business leaders to quickly develop sophisticated new mathematical formulas to meet the challenging demands of commerce.

In the two thousand years since, nothing, as well as everything, has changed.

Asians still have considerable influence in the worlds of applied mathematics and commerce, except now, algorithms aren’t calculated on an abacus, they are power driven at light speed through decentralized blockchain super-computing open ledger networks, which ironically are also designed, built and managed by Asians. It is a trend that has stretched out over thousands of years.

The cornerstone for the FinTech industry is mathematics – applied mathematics;

¤ Cryptocurrency and Fiat trading is in large part about mathematical formulas based on meta patterns of data blended and balanced against the psychology of human behavior.

¤ Blockchain is mathematics applied using the Scientific Theory of Chaos as a fulcrum against a backdrop of artificial intelligence – AI, and machine learning.

¤ Bitcoin ecommerce is mathematics and algorithms tied to supply chains and demand.

¤ Trading mathematics is part science, part art, and as well, part common sense.

When you need your car fixed, you go to a mechanic you trust. When you need to understand the math of crypto trading or blockchain algorithms, you should also go to an expert with proven history.

Envision for a moment that the new world of blockchain and cryptocurrencies is a PENDULUM, with its dynamic traits quantified and modeled based on the Scientific Theory of Chaos.

Not only does the blockchain have self-determining energy, so too do cryptocurrencies that inherently contain an independent force of their own.

Consequently, a more accurate model than a single simple pendulum would be a double pendulum that extrapolates energy in a meta pattern of fractals based on initial pre-defined conditions. Articulating each arm of the double pendulum increases complexity exponentially in short bursts and moves energy instantaneously from order to chaos and back to order.

Watch what happens when a single pendulum is switched to a free hanging double pendulum. It loosely models in an analogous way what happened when Bitcoin came on the scene, and the intense frenzy it eventually generated, only to fluctuate between peaks and valleys.

At what point in the timeline would you BUY, SELL or HODL?

Yes, it’s complex, and when something is difficult to grasp humans often try to simplify, especially proactive Millennials raised in the fake news era who now know how to cut through the clutter. Doing so however can be dangerously misleading because oversimplification sometimes lessens, or worse, misses critical information altogether.

In the worlds of cryptocurrency, some traders rely on BOTS to simplify the complex crypto trading process. Crypto trading BOTS evolve rapidly, with new apps popping up regularly, so it’s difficult to keep up. It’s important though to not be rushed into using AUTO-TRADING-BOTS until you understand exactly how they work.

Crypto trading BOTS are not a one-stop solution and won’t generate revenue without human input and attention. BOTS that promise a free and easy ride are scams. A trading BOT is just a tool, and currently not an auto-drive car like some developers would like us to believe. BOTS must be carefully configured and monitored so you don’t crash and burn your investment.

Advanced crypto trading BOTS allow traders to set specific configurations that execute trades on their behalf. If you set them up properly and define your strategy carefully, as well as monitor the BOT regularly it can be a good tool to help you make profitable cryptocurrency trading decisions. However, if you are sloppy or reckless it could wipe you out in a heartbeat.

In the beginning it’s a good idea to invest only small amounts because BOT risk is higher compared to trading manually. Trading BOTS use pre-set indicators and artificial intelligence to identify patterns and automatically execute trades. Algorithmic meta-pattern trading software has been used by hedge fund managers in other markets for years, so the concept isn’t new, but it is new for crypto.

There are a variety of cryptocurrency trading BOTS on the market – some are free while others are expensive subscription-based apps designed specifically for advanced crypto traders. Like everything though, even the most expensive BOTS differ in ease-of-use, quality, and the profit they generate. One thing they do have in common is that none of the BOTS can guarantee profitable results, although some claim to – so read the fine print carefully. Some also require that you either write your own scripts or license them from a third party.

They are all based on complex mathematical probability algorithms. Many traders mistakenly believe that the crypto trading model is predictable if given enough AI computing power. At best though, BOTS are only kind-of accurate. Computers do predict daily all types of trends in relatively simple systems, but once the level of complexity increases, and regardless of whether it is respective of, for example, a political vote, or whether a river will flood, predictions fall apart at an exponential rate especially when human psychology is folded in.

One has only to look at how poorly meteorologists predict the weather. Currently, they are nominally accurate only about one week in advance. More than seven days ahead and too many variables occur that falsely skew weather predictability. A one day prediction is reasonably accurate, but anything longer falls away rapidly.

Engineers, Civil, IT, or otherwise, rely on complex mathematical algorithms every day. Yet, because of complexity, their unspoken philosophy is “We don’t get paid to do things right. We get paid to do them just right enough.” That train of thought works for building a bridge or a server network because engineers increase tolerances to a point considerably greater than the system or physics require. It is however, a very poor practice for a trader because being out by even one decimal point can cause a catastrophic fail.

The challenge in making accurate crypto trading predictions arises when a third-party dynamic is introduced into the equation – for example events that occur in the parallel fiat market, but, there are of course, many other reasons. If the crypto market were completely segregated and not influenced by outside factors, trading BOTS would be considerably more accurate over a longer range.

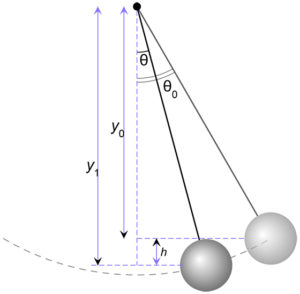

To fully appreciate the level of complexity, let’s look closer at the simple pendulum I mentioned. It’s easy to predict what a swing-like pendulum will do because it only has one pivot point at the top. When you draw the bob up ninety degrees from its resting position and release it, the pendulum swings all the way over to the other side, momentarily stopping at the opposite apex before reversing direction. It then swings back almost to its original starting position, except a bit lower due to the forces of nature. Mathematically, we can predict what will occur based on inertia, gravity, and friction formulas, and we can predict it with amazingly precise accuracy as long as there aren’t too many variables.

If only the trading market were that simple.

The crypto trading market is more akin to a multi-armed pendulum where unpredictability and chaos are inexplicably introduced at random into an ordered system. No one knows why this wild card occurs, but it happens in every system, i.e., from how your heart beats to how the weather inexplicably changes.

This Double Pendulum light writing animation slows things down and traces each sweep so you can see exactly where chaos begins and ends.

It’s also important to consider Probability Theory and the Law of Large Numbers, but that explanation will have to wait for another article. There are also influences analogously similar to Tuned Mass Dampers that are incorporated into trading equations through completely independent third parties, like traditional banks for example. On the positive side, Machine Learning is growing exponentially toward identifying and compensating for chaotic improbability, although there is still a long way to go in this regard. Artificial Intelligence – AI leads the way in that respect

Take a look at this coupled double pendulum – two arms, picture one as Bitcoin, the other … Ripple? You choose. It’s amazing how, when you think the energy is expended, it chaotically explodes again.

Do you think you can still predict what all those pendulum arms will do? Not even the smartest NASA scientists can make those calls accurately. If they could, they would tell us exactly what the weather will be in a month from now. The truth is, AI is impressive, and so are supercomputers and predictive modelling, but we still need human intervention and our complex brains to help traverse the last mile to profitability.

BOTS are a useful tool, but only when placed in the right hands and used properly because trading decisions are not purely mathematical. They also incorporate intuition into the equation, and that part is a human quality that so far machines have not been able to duplicate.

Here’s a pendulum series arraigned in a straight line; Order to Chaos and back to Order.

Choose one of the balls in the line and envision that it is your investment to see how it interacts throughout the entire system … note that each string is a different length, which represents the different characteristics of each coin and the proprietary system to which it is attached.

When you look at all these PENDULUM animations, and envision that each represents a trading scenario, at which point would you BUY, SELL, or HODL? Trading platforms are much more complex than any of these pendulums, and well beyond even the computational power of a BOT. Trading is still a human decision.

The Basics of Pendulum Dynamics by Prof. Dr. Ulrich Vogl

Your best bet, pardon the pun, is to be knowledgeable and use your head!

Happy Trading!

::::::::::::::::::::::::::::::::

Author Maurice Cardinal is a Blockchain Development Advisor and a Crypto Content Specialist at CoinSeason Capital Inc. Maurice has helped develop successful blockchain strategies and ICO campaigns for the news, gaming, healthcare, and cloud computing industries, and has researched, written, and advised about blockchain and cryptocurrency strategies for several years. Maurice is also the author of Leverage Olympic Momentum an early adopter business bible about disruptive marketing.

Author Maurice Cardinal is a Blockchain Development Advisor and a Crypto Content Specialist at CoinSeason Capital Inc. Maurice has helped develop successful blockchain strategies and ICO campaigns for the news, gaming, healthcare, and cloud computing industries, and has researched, written, and advised about blockchain and cryptocurrency strategies for several years. Maurice is also the author of Leverage Olympic Momentum an early adopter business bible about disruptive marketing.

*DISCLAIMER: Crypto Fiat BLOG is not a prospectus, or an investment solicitation … or an offer to buy securities. This BLOG is for informational purposes only and does not constitute relevant opinions on real or hypothetical shares or securities. Information or analysis contained herein does not constitute an investment decision or a specific recommendation. This document does not constitute any investment advice, investment or intention regarding the form of securities. CoinSeason clearly indicates that relevant intended end users have a clear understanding of the risks of using the CoinSeason BLOG and trading platform. CoinSeason expressly states that it will not bear any direct or indirect losses arising from using this blog, including: 1. Economic losses due to user transaction operations 2. Any errors, carelessness or inaccuracies arising from personal understanding 3. Loss caused by trading various blockchain assets and any resulting behavior.